65 Day Rule For Trust Distributions 2022

65 Day Rule For Trust Distributions 2022

This year that date is March 6 2021. Up until this date fiduciaries can elect to treat the distribution as though it was made on the last day of 2020. If the trustee finds there is excess income remaining after accounting for the years distributions the 663 b election or 65 Day Rule allows the Trustee to treat distributions made within the first 65 days of the following year AS IF the distributions were made in the prior tax year. In addition to the federal income tax consequences state income taxes may also be relevant.

The 65 Day Rule Post Year End Tax Planning For Estates And Certain Trusts Boeckermann Grafstrom Mayer

Trustees of non-grantor trusts take actions during 2021 to reduce trusts 2020 income tax liability under IRC Section 663b.

65 day rule for trust distributions 2022. 22 2019 can be treated as having been made in. It appears the 65 day rule does not apply but instead a reasonable period of time standard. The 65 Day Rule allows a trustee to elect to make a trust distribution within 65 days of the end of the preceding tax year and effectively transfer some of the income and its tax liability from the trust to the trust beneficiary who received the distribution.

Under Section 663 b of the Internal Revenue Code any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year. For example a distribution of 500 of trust income by the trustee to a beneficiary on Jan. The 65-Day Rule applies only to complex trusts because by definition a simple trusts income is already taxed to the beneficiary at the beneficiarys presumably lower tax rate.

The 65-day rule is a taxpayer-friendly provision involving the income taxation of trusts and estates. What is the 65-Day Rule. 65-Day Rule By WilkinGuttenplan February 28 2019 January 23rd 2020 No Comments For estates and trusts 663b otherwise known as the 65-day rule states that a fiduciary can make a distribution to its beneficiaries within 65 days after year end and retrospectively apply those distributions as if they were paid in the previous tax year.

What Every Trustee Should Know The 65 Day Rule

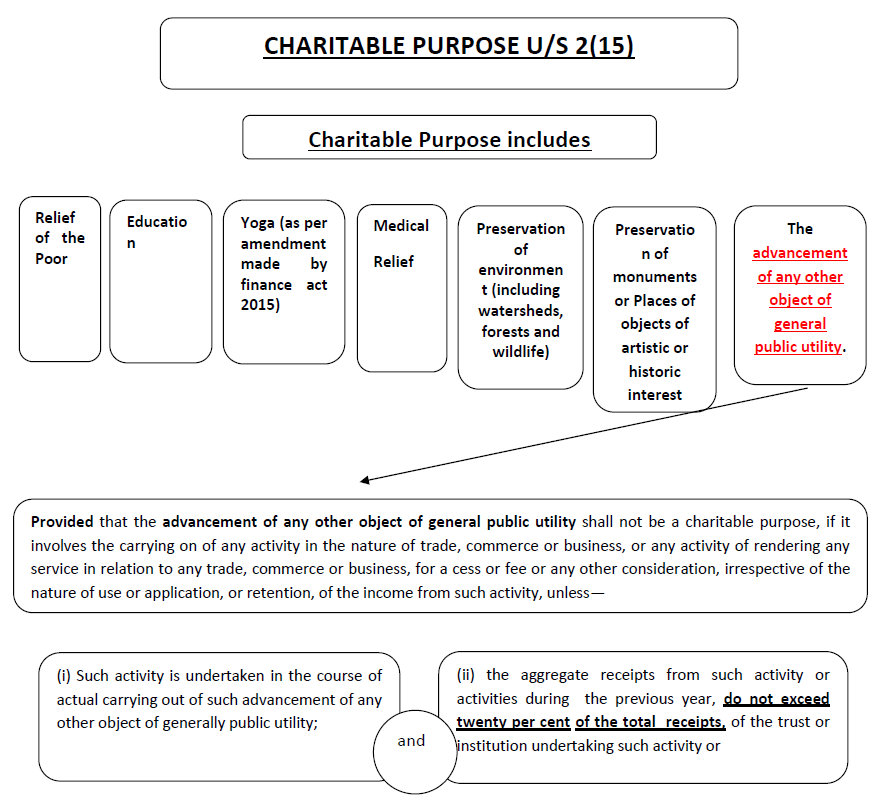

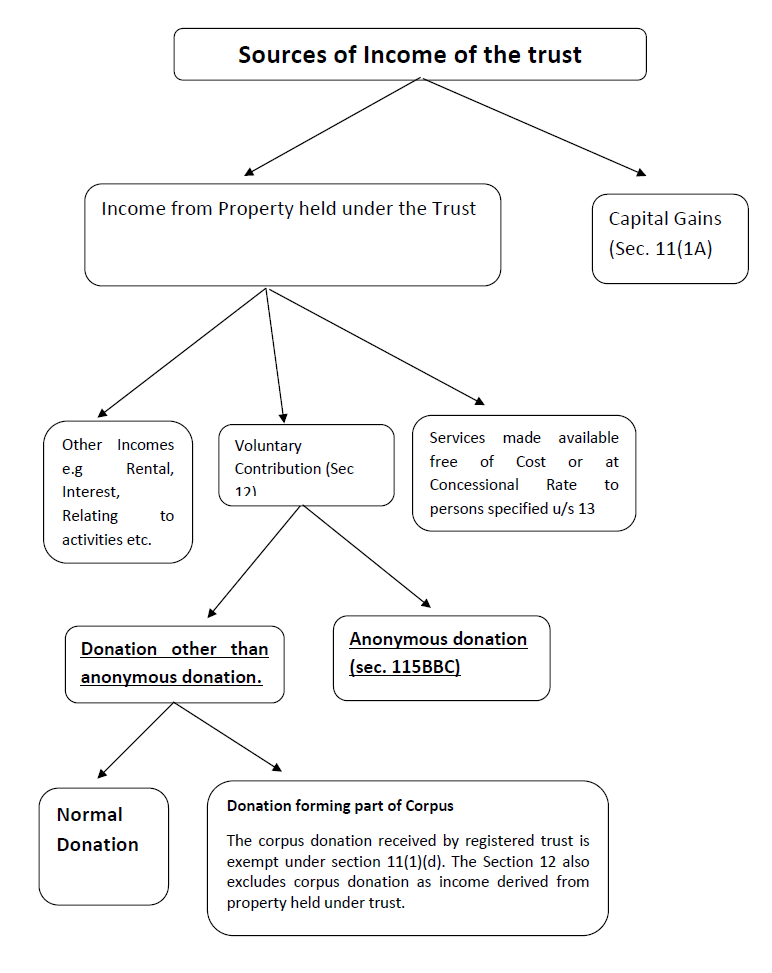

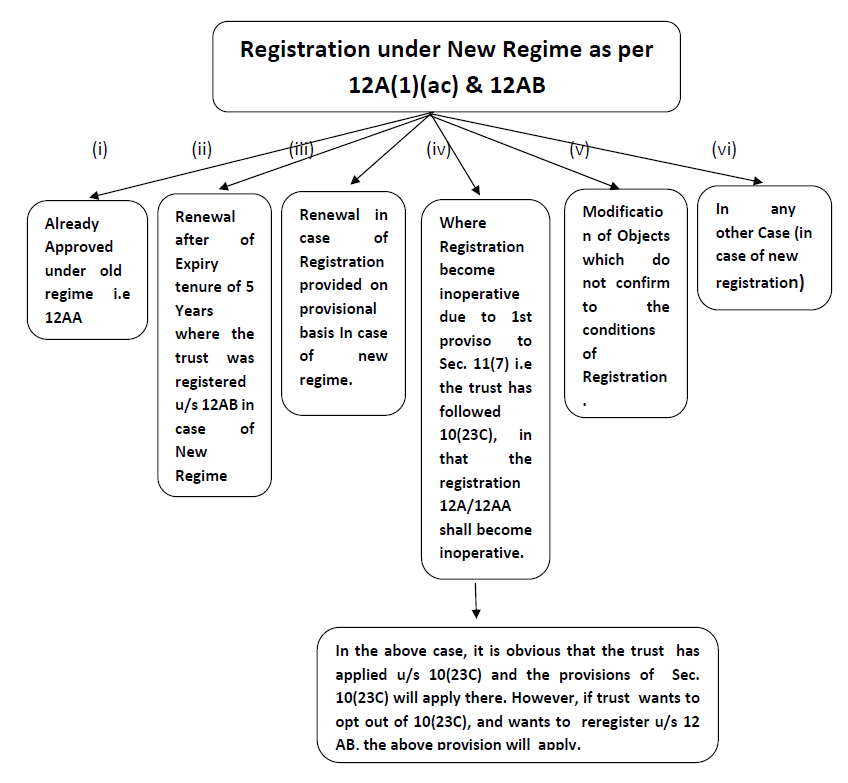

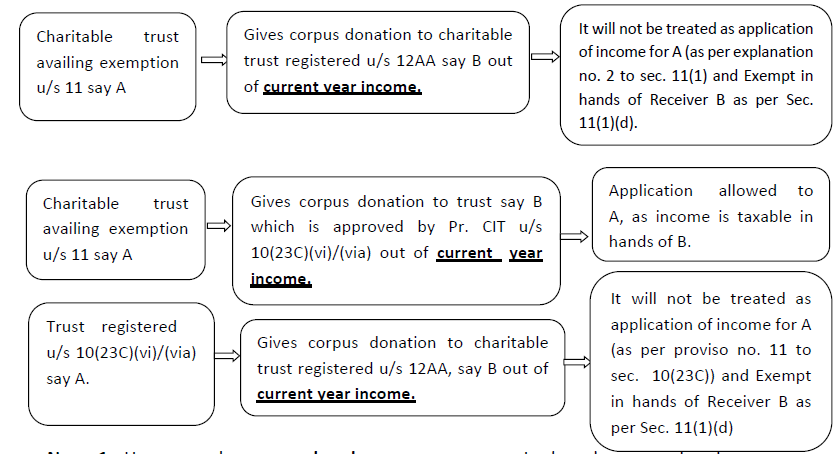

Provisions Of Charitable Trust As Amended By Finance Act 2020

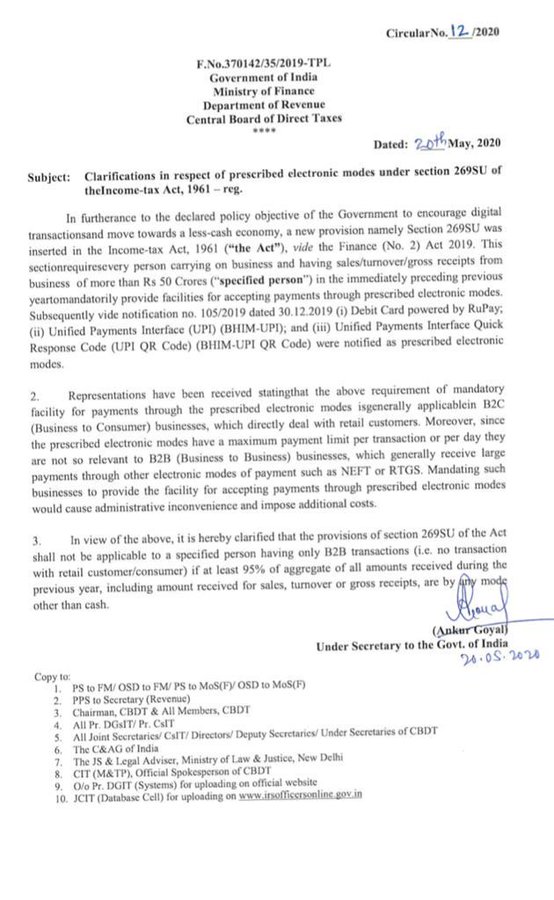

Latest Official Tax Income Tax Tds Updates By Cbdt Of India

Cbdt Notifies New Income Tax Rules Forms For Trust Npos

Provisions Of Charitable Trust As Amended By Finance Act 2020

Did You Know 65 Day Rule Wilkinguttenplan

Income Tax Slab Rates For Ay 2022 23 Taxmann Blog

Income Tax Slab Rates For Ay 2022 23 Taxmann Blog

![]()

Horizon Advisors Trust Planning With 65 Day Rule

65 Day Rule May Provide A Tax Savings Advantage Preservation Family Wealth Protection Planning

Trust Accounting Income Taxation After Tax Reform Bkd Llp

Https Www Premierhealth Com Docs Default Source Default Document Library Morrow 110 Track I Secure Act Morrow Ira Trust Planning Pp Pdf Sfvrsn 4956b4e1 12

Provisions Of Charitable Trust As Amended By Finance Act 2020

Latest Official Tax Income Tax Tds Updates By Cbdt Of India

/required-minimum-distributions-9019da5770284fc0ace6a56792363045.png)

All About Required Minimum Distribution Rules Rmds

Nps Income Tax Benefits Fy 2020 21 Old New Tax Regimes

Provisions Of Charitable Trust As Amended By Finance Act 2020

Everything You Need To Know About Filing 2020 Taxes For 2021

Post a Comment for "65 Day Rule For Trust Distributions 2022"